- Company Registration Number

- Trust Registration Number

- Tax Number

- ID Number

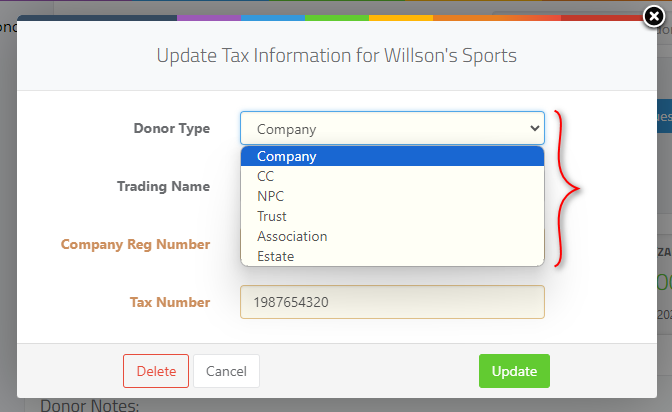

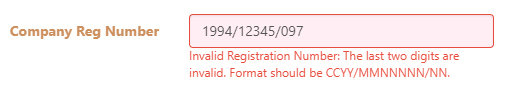

1. Company Registration Number

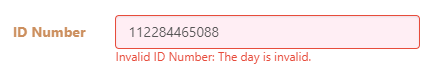

A valid South African Company Registration Number needs to be in the following format: CCYY/MMNNNNN/NN. When selecting a donor type make sure that “company” is selected, as shown below.

| NB: The format for registration numbers will be the same for NPC’s and CC’s. |

Examples of invalid Company Registration Numbers:

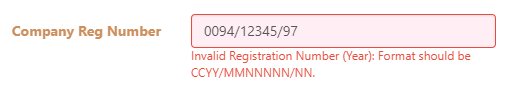

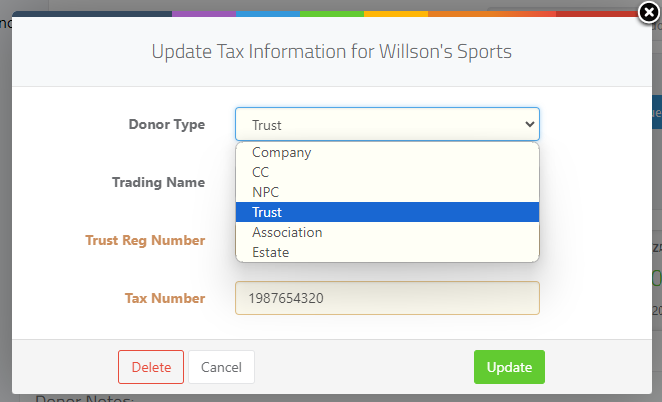

2. Trust Registration Number

A valid South African Trust Registration Number needs to be in the following format: ITNNNN/CCYY. When selecting a donor type make sure that “trust” is selected, as shown below.

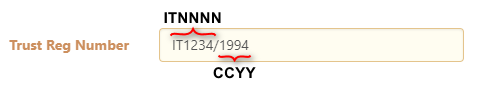

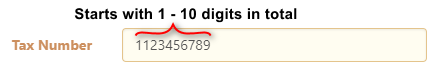

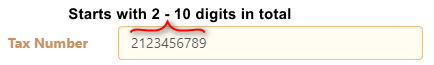

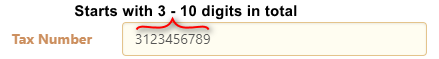

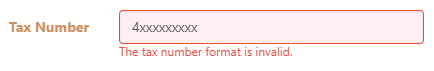

3. Tax Number

A valid South African Income Tax Number needs to have 10 digits and can only start with 0, 1, 2, 3, or 9.

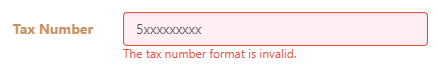

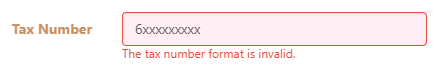

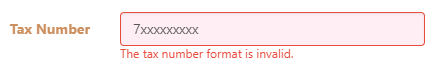

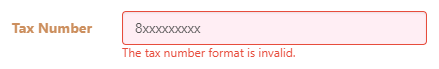

Examples of invalid Tax Numbers:

Numbers starting with “4” are VAT Numbers.

Numbers Starting with “7” are PAYE Numbers.

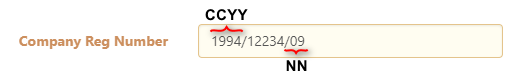

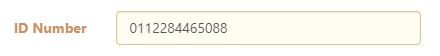

4. Identity Number

A valid South African Identity Number needs to be 13 digits in the following format: YYMMDDSSSSCAZ

- The first 6 digits [YYMMDD] are the date of birth. 10 May 1994 is displayed as 940510.

- The next 4 digits [SSSS] are used to define your gender. Females are assigned numbers in the range 0000 – 4999 and males from 5000 – 9999.

- The next digit [C] indicates the South African citizen status with 0 meaning South African citizen. 1 means permanent resident and 2 means refugee.

- The last digit [Z] is a checksum digit – used to check that the number sequence is accurate using a set formula called the Luhn algorithm.

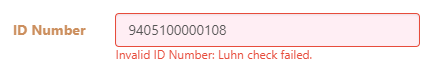

Examples of invalid Identity Numbers: