Oftentimes, your donors will contribute to your organisation on a regular basis throughout the year. In this case, you may want to issue one Section 18A tax certificate for all their contributions during the financial year. ActiveDonor allows you to create a “Batch” certificate that can combine two or more receipts.

Creating Batch Certificates:

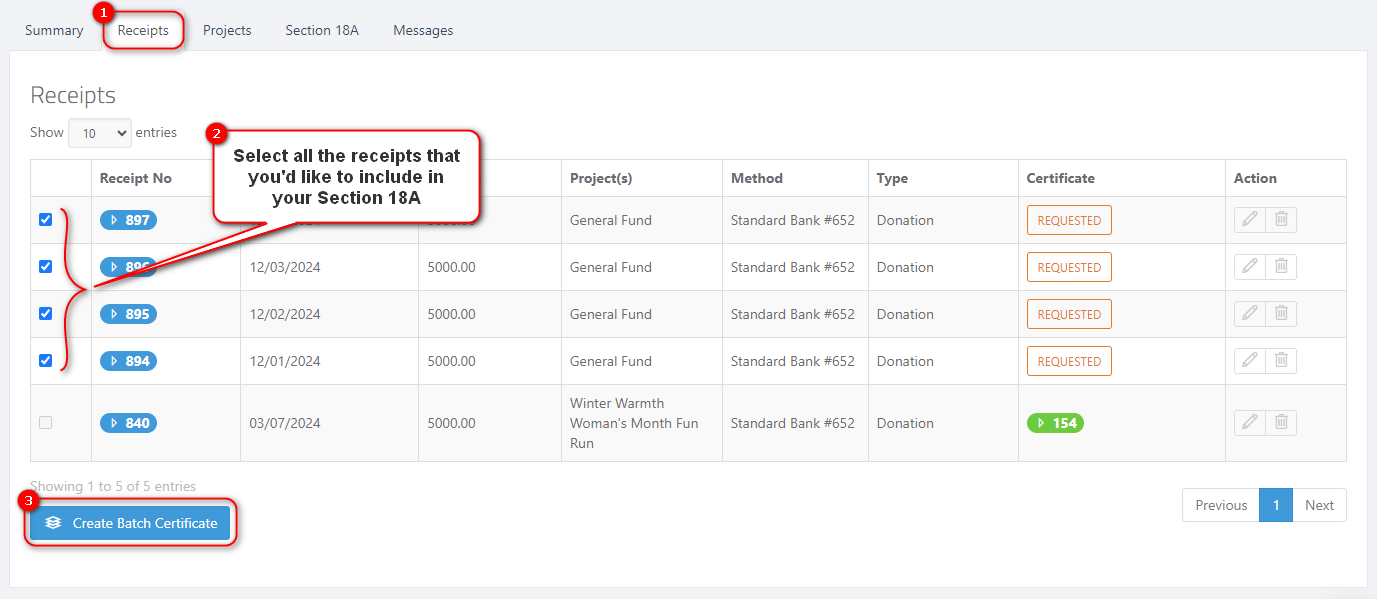

- Open the donor’s profile.

- Navigate to the receipts tab

- Select all of the receipts that you would like to include in your batch certificate.

- Finally, click on Create Batch Certificate button.

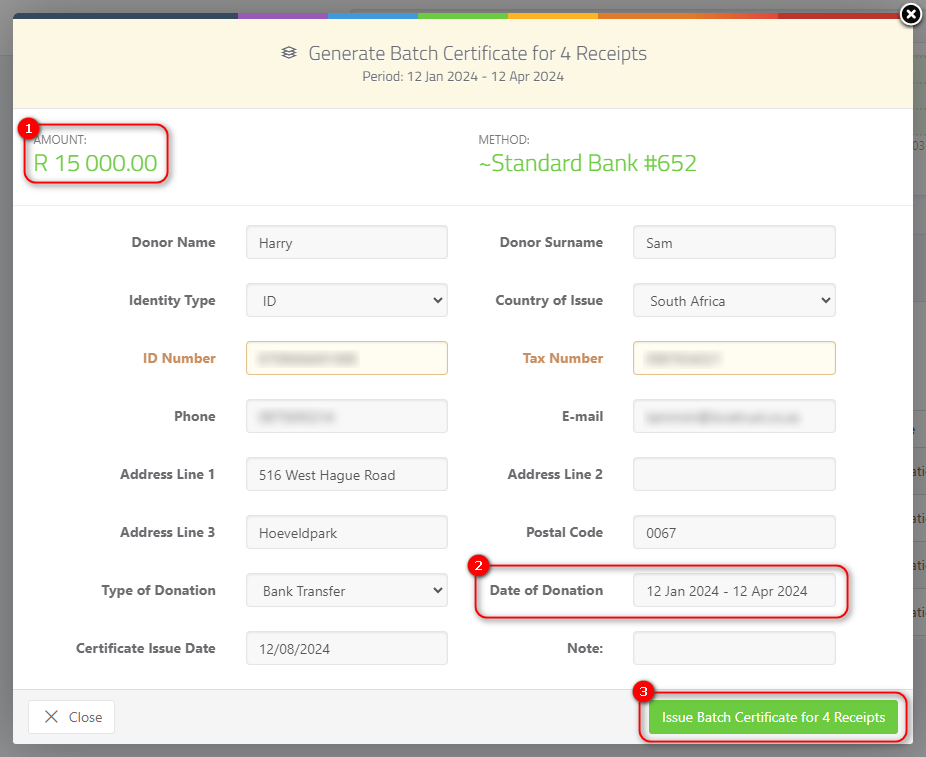

Next, ensure that the certificate details are captured correctly, specifically

- Total receipts amount received by the organisation

- The duration of the receipts e.g. 12 January 2024 – 12 April 2024 or 2024 Financial Year etc.

- Once you have confirmed all the details as captured correctly, press the Issue Batch Certificate button to generate the final certificate.

Statement of Donations

Batch certificates issued automatically include a detailed breakdown of donations. This makes it easier track and report on donations, providing full transparency for your donors and simplifying your financial records.

Regenerating Certificates

If you have previously issued a batch certificate that does not include a statement, you can manually refresh the certificate to add a statement using the Regenerate button on the top right corner of the page.